XVC 2021 Annual Letter

Below is the edited transcript of Boyu’s speech from the XVC Annual Conference 2021:

Hello, everyone. Thank you for attending the XVC annual conference 2021. It has been five years since the initial close of our first RMB fund and four years since the initial close of our first USD fund. By October 31, 2021, the total cost of our investments was USD 378.9 million, and the market value was USD 834.5 million, representing a gross IRR of 56.7%.

Things have changed so much in 2021 that it feels as if we are living in another world. The COVID-19 pandemic has dramatically changed our lives, and it has become the new normal. The U.S.-China relationship is still in a cycle of confrontation. As you might have noticed, some Chinese companies listed in the U.S. have been seeing huge volatility in stock prices in the last few days. The Chinese government has strengthened supervision and regulation across broader areas, including anti-monopoly, information security, e-cigarettes, tutoring, housing, etc., and these new regulations have had a very big impact on some industries.

This prompted us to think about three questions: What new opportunities could these changes bring to long-term value investors? What remains unchanged behind all these changes? And what should we change about our investment strategies?

Our conclusion is that most important things remain unchanged; these things are more long-term and more worthy of our attention.

For example, we did some research on government regulation. We found that most of the regulations are programmatic, precursory, and consistent. For example, the new education policy had been planned and laid down in the 14th Five-Year Plan. What’s more, the logic behind these regulatory policies is quite clear: it’s always aimed at enhancing the country’s long-term competitiveness and improving people’s livelihood.

How about COVID-19? We believe it accelerates some structural changes instead of creating them. The basic needs and decision-making logic of governments, businesses, and consumers remain unchanged.

So, we believe that our investment strategies still work, and we don’t plan to change them.

This slide shows a framework we use to analyze structural changes.

The horizontal axis measures the visibility of changes in certain areas, while the vertical axis shows whether there will be changes in the scarce resources in certain areas.

Let me give you a few examples to explain what a scarce resource is: for technology-driven industries, a scarce resource is a certain core technology or data that can be protected and owned exclusively; for self-reinforcing brands, a scarce resource is a user mentality that may occupy a certain demand scenario or a consensus formed within a core target group; for products and services with economies of scale on the production side or fulfillment side, a scarce resource is the scale of its loyal users as well as its production capacity and fulfillment network that are hard to build without the scale.

Above all, a scarce resource has two distinctive features:

- It is something that no one else can have when you own it. It has strong exclusivity;

- It can significantly improve your pricing power over your counterparties. “Counterparties” here not only refers to your customers but also the parties on the supply side, for example, your suppliers, your employees, your landlords, and even the government. If you own the scarce resources, you will have greater pricing power over them, and you will be able to maintain a high ROE in the long run and create long-term value for your shareholders.

Using this framework, we arrive at the conclusion that some of the big changes we just mentioned, such as COVID-19, the anti-trust regulation, Sino-U.S. friction, etc., don’t create significant changes regarding scarce resources and don’t create incremental investment opportunities for long-term value investors.

So, what structural changes does XVC focus on?

First, we spend a lot of our time watching and understanding the changes in demography, retail and fulfillment channels, and media consumption habits.

The graph on the left shows that China’s consumer spending has continued to grow fast. The dotted line shows Japan’s consumer spending, and although we have surpassed them in total, considering that China’s population is about 11x Japan’s, China’s consumption per capita is only one-fifth of Japan’s.

The chart on the right– you saw a similar one last year – shows the growth of five new retail channels since 2017. These channels are Taobao Live, Kuaishou e-commerce, Douyin, WeChat mini-programs, and PDD. These channels have only been around since 2017 but have achieved a total GMV of over $1.1 trillion USD in just five years, which is about 3.6x Amazon’s total GMV in 2020.

This is an example of changes in demography. From 2016 to 2020, the average family size in our country shrank from 3.11 to 2.62, which means the number of people in each household continued to decline. Meanwhile, industries related to family size were changing. For example, the penetration of food-delivery in the restaurant industry went up from 5% in 2016 to 19% in 2020. There are two other interesting industries, but they are not yet large in the economy. In the same period, the penetration rate of floor-sweeping robots has tripled to 5.5%, and the pre-installation rate of dishwashers in high-end furnished homes has grown almost tenfold.

Another structural change we have been watching is the cloud and AI – software is eating the world, and the cloud and AI are eating software.

The chart on the left shows the growth trends of cloud services in China in recent years, including IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and SaaS (Software as a Service). The growth rate has been accelerating, and the total market is already quite large, reaching over $100 billion RMB.

Upon horizontal comparison, it’s clear that China’s IT spending is not high enough; the total GDP of the United States is only about 30% higher than ours, but its IT spending is almost 7 times higher.

One important reason for this is that in the 30 years after the reform and opening-up, China had been enjoying tremendous demographic dividends, so business owners didn’t have an urgent need to pursue efficiency in most industries. However, this is changing. The right graph shows the UN’s prediction of China’s demographic change in the next 80 years, and the top curve shows the absolute size of the working population aged 25 to 64. After decades of rapid growth, the size of the working population had entered a plateau in the past few years. The inflection point of the working population will appear in 2025, after which the size of the working population will begin to decline rapidly.

This change has already imposed an impact on the economy. One obvious impact is that salaries have already started to rise. The construction industry has been in decline over the last few years, but against this background, construction workers’ salaries were still rising by 7%~10% per year.

As a result, intelligence and automation will accelerate, and the replacement of manual labor by machines will pick up speed, and this is something that will happen across industries. Software services, for example, can improve employee efficiency and allow fewer people to do more; robots and automated systems are going to be used in factories and warehouses; and you may see self-driving trucks on the road very soon. These changes will also happen inside the homes of consumers. It’ll happen in both China and the rest of the world. For example, lawnmowing robots and pool-cleaning robot sales have seen explosive growth in North American and European markets.

The third structural change we have seen is “China Efficiency.” This is an abstract concept and a little difficult to understand.

Let’s look at three proxy variables first.

The first signal is that most of the big sellers on Amazon are now from China. In January, 75% of new Amazon sellers were Chinese, compared to 47% in the same month last year.

The second signal is that China now has the highest number of patent applications in the world – look at the red line – this only happened in recent years.

The third signal is that TikTok has surpassed YouTube in average time spent per user this year. And there’s another proxy variable: China is the only country in the world that has the COVID-19 pandemic under control.

These signals suggest that the “Chinese supply chain” is globally competitive. This includes our infrastructure, energy, raw materials, spare parts, logistics, technology, talent, and organizational capabilities. There are cultural and institutional factors, as well as a strong economy of scale that benefit from China’s huge domestic market. All these factors are long-term and structural.

Let’s take another look at this analysis framework. XVC has been betting on structural changes that are long-term, huge, and highly certain.

“Long-term” means that these structural changes take place over the long term and would bring about long-term behavioral changes that are not going to be easily reversed (the COVID-19 pandemic and trade war do not fall into this category); “huge” means that they would bring huge changes to spending; and “highly certain” means that the changes themselves are highly certain, and it’s also highly certain that they would bring permanent changes to purchase decision-making.

These structural changes will lead to changes in scarce resources and most likely result in the creation of “whales” that are ideal for long-term value investors.

XVC has been betting on the opportunities behind these three structural changes.

Up to now, the average revenue of our 40 core bets has been about 50 million dollars, and it’s still growing fast. I want to say that this impressive growth is not a coincidence. Such growth is neither “capital-driven” nor “bubble -driven.” Of the current core bets in our portfolio, about half are profitable or cash flow positive. This is very rare for high-growth companies. The magnitude and quality of the growth are sending us early feedback that we are spending our time on the right things.

By this point, you may be wondering: these structural changes seem to make some sense, but most other funds out there are investing in these areas, so that’s not something exclusive to XVC. How is XVC different from its peers?

The first difference is that we focus on finding models that make friends with time and avoid businesses that rely on inefficiencies of new markets.

What kind of pattern can make friends with time? Think about it: almost everything we see with our eye today has a strong ability to self-reinforce or self-replicate; otherwise, it would die out and wouldn’t be seen by us. Business models that make friends with time have similar abilities.

We have summarized several types of “self-reinforcing businesses,” the first being platforms with network effects; the second being applications that can monopolize data and use data to optimize their own experience; the third being products and services with strong economies of scale; and the fourth being self-reinforcing brands.

On the left side of the chart above, I have given some examples of businesses that depend on inefficiencies in emerging markets. You might wonder how anyone could invest in these businesses. But the fact is that there are a lot of people who are investing in these projects, including many other top VC funds.

Let me use two of our investments in the past year as examples of “self-reinforcing businesses.”

Company H is an intelligent warehousing equipment and solution company that offers “FBA” services. We were following it for three years until we saw solid evidence of product-market-fit in its latest version of its “Picking Spider System.” It can reduce manual labor in warehouses by leveraging the robotic equipment and grasping algorithms while achieving a few major breakthroughs in storage density, access efficiency, construction cost, and inventory accuracy.

We like the company because, in addition to being in a huge market, it has the potential to achieve self-reinforcement.

An automated warehouse is a complex system that not only requires robots of different types to collaborate with each other but also a fully integrated software system that works well with the inventory management system, logistic system, and even the order prediction system. The hardware system contains lots of custom parts and has a scale advantage on production, maintenance, and service. In addition, the software system can leverage data and experience it accumulated to optimize the grasping algorithm and storage strategies; so, the more warehouses the company manages, the smarter the system would become. Therefore, the learning curve of economies of scale for Company H to improve its cost, efficiency, and quality is very long.

Moreover, we got an insight from another portfolio of XVC, Weee!, the largest online grocery store for minorities in North America. When its product offerings grew rapidly, the picking cost of Weee! was rising rapidly, and the team started to consider replacing manual labor with machines to pick and pack the orders. They were considering adopting AutoStore. (It’s a company that recently went public at around $16 billion market cap.). We were looking at Company H at the time, so we recommended it to Weee!. Comparatively speaking, Company H was much more cost-effective, and they were able to offer a price that’s 80% cheaper than AutoStore.

But Weee! still chose AutoStore in the end because AutoStore has many successful cases and has established mature service capabilities in the U.S. On the demand side, what Weee! cared about the most was the stability of the system. They were willing to spend more money on the warehouse but could not accept it if the system crashed and affected their order fulfillment, which would hurt their customer trust and their brand.

This case gives us the insight that smart storage systems have the chance to build a self-reinforcing brand. The existing customer cases and service infrastructure of a company can help it gain new customers. Its customer density can, in turn, help the company acquire even more new customers.

Another example of self-reinforcing business is the company CHAGEE, a bubble tea chain we invested in about 11 months ago.

What we learned from Starbucks and Tim Hortons is that standardized “super SKUs” with long-term user retention, coupled with high regional density, can build a “consensus-driven brand” among users, which can crowd out competitors targeting similar user groups.

When we did our research on CHAGEE, we saw several interesting indicators that suggested it may have created that “consensus-driven brand” in the cities they were in.

First, its top SKU, which wasn’t first on its menu, contributed to nearly 40% of its revenue, and the percentage was still rising. Second, its customer repeat purchase rate on online platforms was more than two times that of its peers. Third, when its store density increased, same-store sales didn’t drop but grew at a double-digit pace.

We interviewed some citizens on a street with no CHAGEE stores and cross-verified our assumption – people in that city not only have high recognition of CHAGEE’s brand (mention rate among “top brands”) but can also name the top SKUs among CHAGEE’s products. Seeing these signals, we got very excited, launched management interviews immediately, and signed the deal afterward.

When we examine business models, in addition to understanding self-reinforcing elements, we also try to identify and avoid “diseconomies of scale.”

Let me explain what “diseconomies of scale” means by an example.

We studied a discount retail chain selling near-expired food that had very good single-store numbers and was able to reach a 15% contribution profit margin on the store level. But in our research, we found a few other smaller players in the industry with very good profitability. We found this quite strange because, usually, the larger the purchase volume, the lower the cost and the higher the profit. So, we did some interviews with the upstream supply chain. We talked to 3 or 4 procurement managers at different levels and several store owners on Jinyuan Road (a wholesale market for leftover inventories).

We found that the most cost-effective goods in the leftover inventory market are often not very large in scale and the sellers prefer customers who pay in cash. This is a market for opportunistic sourcing, and such a market has characteristics of diseconomies of scale, as it’s difficult for a procurement manager to source top goods on a large scale, while inefficiencies in management of sourcing also increase as the business scales. As a result, a chain can reach an optimal efficiency at a small scale in this industry.

This type of business will soon be constrained by certain key resources, leading to a situation where “the larger it scales, the less efficient it becomes.” Some typical key resources with “diseconomies of scale” include customer relationships that are held in the hands of front-line employees (dental clinic chains, pet hospital chains, headhunters, decoration companies). In some industries, smaller players have a cost advantage. Sometimes, we can also find situations where “the bigger the brand, the more vulnerable it gets” (for example, medical cosmetology chains – it’s almost certain that accidents will happen, but the bigger the brand is, the harder it gets hurt whenever an accident happens).

We have trained ourselves to be sensitive to different types of “diseconomies of scale,” and this has helped us to avoid many traps.

The second difference is that we use behavioral signals to identify “S-class founders.”

When we do our research on a company, more than half the time, we make a judgment about the founder. Judging a person requires the use of various proxy variables: we talk to the founder; we talk to the people around the founder; we talk to the employees; we constantly look for behavioral signals within our framework that help us make judgments about people.

This is not easy. In most cases, we only have a very short time to make our investment decisions. Sometimes we also have to identify unreliable information during the research process because the founders will try to make themselves look better.

To address these issues, we created a simple model of great founders, which mainly looks at two key points: the first is the ability to make good decisions, and the second is the ability to build a strong organization. This framework allowed us to stay away from some disasters in the making and helped us avoid missing out on some of the greatest founders due to distractive information.

Let me use the example of CHAGEE again. When I first met the founder, Junjie Zhang, he told me that he had never attended school. My first thought was that he didn’t go to college, but it turned out that he had received no education at all. He was on the streets from the age of 10 to 17, so he didn’t know how to read and write before he was 18 years old. Even today, he sometimes needs to write certain words in pinyin when he presents ideas to us on a whiteboard.

Can we invest in such an entrepreneur?

During our conversations with Junjie, we were constantly asking questions to help us find out how well he can learn, whether his learning ability could help him make the right decisions in the future, and what kind of decision-making habits he has. What we discovered during this process was that although he has received no education at all, he is a very good self-learner. He managed to listen to a lot of audiobooks. He has a better understanding of business models and better insight into management than most CEOs we know. And he is continuously learning, thinking systematically about issues, and making rational decisions.

We also observed his organization to see if he could organize his team in a proper manner and run it efficiently. He had built a good team. As a proxy signal, several senior members of HeyTea, including a co-founder of HeyTea, joined CHAGEE when it was still very small and headquartered in a small city – Kunming. We spent a whole day talking with his core team to understand how he observes people, what he did to attract and incentivize them, and what mistakes he made with organization in the past. In the end, we were convinced that he is a confident, humble, yet smart person with very high EQ.

If we made our judgment based only on his educational background, then we’d be making a big mistake. Now, having worked with CHAGEE for a year, we are very happy that we made the right decision to believe in Junjie and invest in the company.

The third difference is that we do not accept “fake it until you make it.” We have built an anti-fraud team that has identified eight fraud cases in the last two years and saved close to 50 million USD, which could have gotten into the wrong hands. Most of these companies managed to raise money from other funds. I recently heard that one of them raised several hundred million RMB from a group of top firms.

The fourth difference is that we truly believe that good post-investment services can make a difference, so we designed and implemented our post-investment services with a long-term mindset. The key idea is helping our founders accelerate their learning curve on organization-building. The insight behind the strategy is that a lot of well recognized, great entrepreneurs today were once immature in organization-building, especially when their organizations were growing from 30 people to 300 people. We believe this portfolio development practice may one day become a long-term strategic advantage that XVC has over its peers.

We’ve recently updated our website. We asked some portfolio CEOs to write something for us about how they feel about working with us. It seems that the idea of helping entrepreneurs with organization-building has been well received.

Sometimes we get questions from LPs about the rising competition in the industry. Some firms raised very large funds, hired lots of people, and started deploying the funds very quickly. How does XVC cope with such “involution” in the industry and compete with other top funds? Why haven’t we expanded our team to achieve better coverage? And how should XVC react when other firms choose to do so?

For the past few years, we’ve been doing a review of our coverage around every six months. We use a spider to put down some data from IT Juzi (it’s a database similar to Crunchbase). We filter out the companies that have raised Series As or Series Bs in the last two years and rank them all according to their latest valuation. We then pick the top 100 companies to see XVC’s coverage. Here, “coverage” means we met the team in person when they were raising their Series As or Bs.

It turned out that our coverage has been consistently around 50%. I am not particularly satisfied with this result, but my way to achieve better results is by trying to think harder instead of hiring more associates.

Another important number is that from 2017 to now, our win rate as the lead investor is close to 90%. What does this mean? It means that if we issue a leading term sheet to a company that has not yet signed a term sheet with another firm, nine out of ten times, the company will choose XVC as the lead for that round. And in the remaining cases, the company will let XVC co-invest.

Many LPs might worry that the top firms with large teams would sift through all projects, pick out the best ones for themselves, and leave the rest to other firms. But, in the real world, this doesn’t happen. Even the top firm in the industry only invests in about 200 deals a year, but this is only a drop in the ocean compared with all the startups out there. Grabbing up all the best deals is impossible unless some firm has the miraculous power to ensure that they can accurately recognize every “diamond in the rough.” Well, as LPs, it’s not hard for you to check it out how they are doing. Just look at their performance and their success rates – they can’t be higher than sniper funds.

So far, XVC has made 40 core bets, with an average holding period of less than two years. Four of them are unicorns, and 10 are valued at over $300 million. The average annual revenue of these core bets is $50 million USD. Most of them are growing at a rate of over 100% and yet are still more than 1000% away from their ceiling. If we liquidated all the companies we’ve invested in at their current market value, our gross IRR would stand at 56.7% (this number already accounts for the loss from several mistakes that we made in the early years).

So, my conclusion is that the small team has not negatively affected our coverage or performance. You may wonder why. How did this happen? Let me explain how it worked.

First, small teams are actually more efficient in several ways, one of which is the “concentration of knowledge.”

I have a theory: research that goes across industries, markets, and time-space can create a certain network effect, and this is revealed in several aspects:

First, such cross-market and cross-time-space research can help us see the deeper underlying logic. There’s an old saying in China, “The true face of Lushan is lost to my sight, for it is right in this mountain that I reside.” This means “you can’t see the problem if you are in the problem.” If we keep our eyes fixed on a certain market for too long, we’re very likely to get used to what it is and fail to see the supporting environment and the implications when changes come.

For example, in a trip to India, we saw how a milkman can deliver over 100 orders in two hours. In a call with a hedge fund manager in the UK, we learned why a truck of Ocado (the largest e-grocer in UK) can deliver less than twenty orders in a day. When we ride with a delivery man of Weee!, we learned why he needs only 3 minutes to deliver a package to a customer living in a house but needs 7 minutes to someone living in an apartment. Such surprises prompted us to explore the underlying rules and logic of business and to identify the root causes behind a phenomenon. Doing so allows you to challenge yourself and build a stronger base model of the world so that you’re able to see much deeper and learn much faster when you are faced with new problems.

Second, cross-industry, cross-market, and cross-temporal research allow us to “ride the time machine” to explore investment opportunities. “Riding the time machine” means applying the model and patterns we observe in one market to another market. This is a theory developed by Masayoshi Son. For instance, we applied a lot of knowledge we learned from the Chinese market to our investment in Weee!.

Third, it allows us to make better judgments about the founders.

Before we have the conviction to invest in a company, we sit down with the founder and go through the key decisions he has made – his target customers, his product strategy, marketing strategy, supply chain, how he hired his core team and built his organization. And usually, once we have built our conviction in that company, we do a reverse pitch to the founder and show him our understandings and the work we have done. In order to engage in real conversations with the founders on these issues, an investor needs to have a tremendous amount of cross-industry knowledge and experience in order to be able to learn fast enough. It’s hard for me to imagine how an investment firm with 100 investment professionals can manage to do this.

Such cross-industry knowledge cannot be gained by building a large-scale investment team. Instead, it can only be achieved with a small team, where massive amounts of knowledge, experience, and capabilities are concentrated in a very small group of people.

This slide might give you a clearer idea of this network effect. Every time we look into a new company or a new industry, we are actually building upon our existing knowledge of a few other industries.

For example, my partner Rickey was trapped in Japan in the early days of the COVID-19 outbreak. During that time, he investigated a discount retail chain called Kobe Bussan. We followed up on this research by doing some research in the discount retailing industry. Then, we studied the evolution of the condiment, frozen food, and prepared food industries in Japan. This series of research projects has deepened our understanding of retail, private brand, and self-reinforcing brands based on taste memory, as well as different learning curves of their supply chains. And based on these understandings, we made several core bets.

In addition to the network effect, a small team can also play to its advantage and make the first 99% of the decisions more efficiently.

People might have the impression that investment decisions are made by the investment committee. But, in the real world, the investment committee plays a very limited role in the whole selection process. The reason is that no matter how many people there are in an organization, 99% of the decisions are made by the front-line investment staff alone.

Why? Imagine you are a team leader who manages a four-person team in a large firm. Your team sees 8,000 opportunities a year, but due to limited time and energy, you can only meet 800 teams in person. Among these 800 companies, you can only do research on about 80 of them, which means you need to start 1.5 due diligence projects every week, and it usually takes about two weeks to complete one; so, at any point in time, you have three due diligence projects going on simultaneously. This is a lot of work, and it’s very much the same with the work schedule of investors in all VC firms, large or small. Since you can’t find a way to do your research on more projects at the same time, 99% of the companies your team has looked at were passed on before even reaching the due diligence stage.

So, who is making the decisions to pass on this 99% of companies? The front-line investment professionals who had the earliest access to the companies!

The decisions made by these front-line staff determines which companies will be investigated in depth by the firms, and the decisions made by the investment committee can only affect the 1% of companies that have made it to the deep research stage. For example, Forty-Nine Union had previously talked with one of the largest funds in China, who passed on the deal without even asking for the data or doing any due diligence. Similar to this, 99% of the decisions were made extremely quickly.

The advantage of a small team is that we can ensure that every front-line investment professional has the same level of decision-making skills as the “investment committee members” and that they can make quality decisions alone in the screening process. This is how we play to our advantage to ensure higher efficiency in 99% of the decision-making. I am proud to say that every member in our deal team is smarter than me, and each one of them is more experienced than me in certain areas.

Another advantage of XVC is that our investment philosophy is not only unique but also clearly stated, consistent over time, and well understood and adopted throughout the team.

On the other hand, large teams have to deal with diseconomies of scale.

Now I’ll explain why big teams are also less efficient in making the remaining 1% of decisions.

Let’s assume we have a 100-person investment team, and we need to make it efficient. The first thing we need to do is to divide it into 20 small teams because that’s the only way human beings are able to be organized.

Now we have a choice to make. We can either give each team leader the power to make investment decisions or centralize the decision-making power and have a central investment committee to make decisions.

Let’s explore the second option first.

The total amount of information processed by any investment committee cannot increase with the size of the committee (the number of people on the committee). A 10-person committee can only process the same amount of information as a one-person committee because each committee member has to digest all information of every deal before he votes. However, the decision quality of that committee will drop as the number of decisions it is asked to make goes up. This is because the average amount of information per decision is reduced. This is simple math.

Now, let’s explore the first option, which is giving each team leader the power to make investment decisions.

In the real world, this is very rare because the feedback cycle of our industry is too long, making it hard for any firm to delegate their decision-making power to each team – and if they did so, why should the LPs invest in that big fund instead of the top one or top two of the 20 small teams directly?

But let’s assume we do this anyway. First, I want you to understand that there are almost no synergies across teams. (On the contrary, they tend to keep information from each other. And they don’t have the capacity to process information even if they are willing to share.)

So, we can view each small team as an independent fund that only looks at certain area. Being very focused on a small area for a long time does have its advantages – for example, better deal access at an early stage and deeper domain knowledge. However, there are some big disadvantages too.

The first problem is that doing so reduces the team’s sensitivity to structural changes. We have talked to many sector-focused fund managers. We found them very knowledgeable about the area they focus on – they know the tech, the cost structures, upstream players, downstream players, and even the names of people in that sector. However, we often find that since they lack the “network effect” that comes with cross-industry exposure, they can only think along the logic of their particular industry at that particular time, fail to see the long-term structural changes that are reshaping the industry, and are not sensitive to shifts of scarce resources. In other words, they know how things are working – but don’t know why.

Another problem with sector-focused teams is incentive misalignment. Every year, there are only a few great opportunities, and the chances are only a few of the 20 small teams can win that lottery. But the other teams need to do deals, or they’ll get fired. Plus, the cost of missing out on a deal is not compensated by the benefit of waiting patiently. So, each team member meets with more companies than their peers in sniper funds. In the end, they either fire bullets that should have been saved or explore opportunities outside of their mandate. The teams who see the big opportunities that year may not be able to capture them, either because they may misunderstand them or, probably, have already invested in the target company’s competitor and fell in love with it.

In the chart you are looking at, I introduced two new concepts, and I’d like to explain them to you. The first is shallow coverage, which refers to how many founders the employees of a firm can meet in person; the second is deep coverage, which refers to how many top deals in a particular year that the firm has seen and actually understood after launching quality research.

To my mind, the reasonable size of an investment team would appear in the shaded area in this slide. This is because a team of this size can achieve the highest efficiency and quality in its deep coverage, which means that it’s able to make investment decisions of the highest quality.

Let’s get back to XVC. Let me spit out a question for you – “You have a small team, fine, but what do you do on a daily basis to make sure you don’t miss the big whales?”

To sum up my answer in one sentence: we work on the changes and the unchanged.

We try to find the migration pattern of scarce resources behind structural changes and identify the great next-gen companies that will adapt to the new environment and capture scarce resources in advance. Ideally, after these companies have taken hold of the scarce resources, they’ll be able to maintain their leaders’ advantage for a very long time.

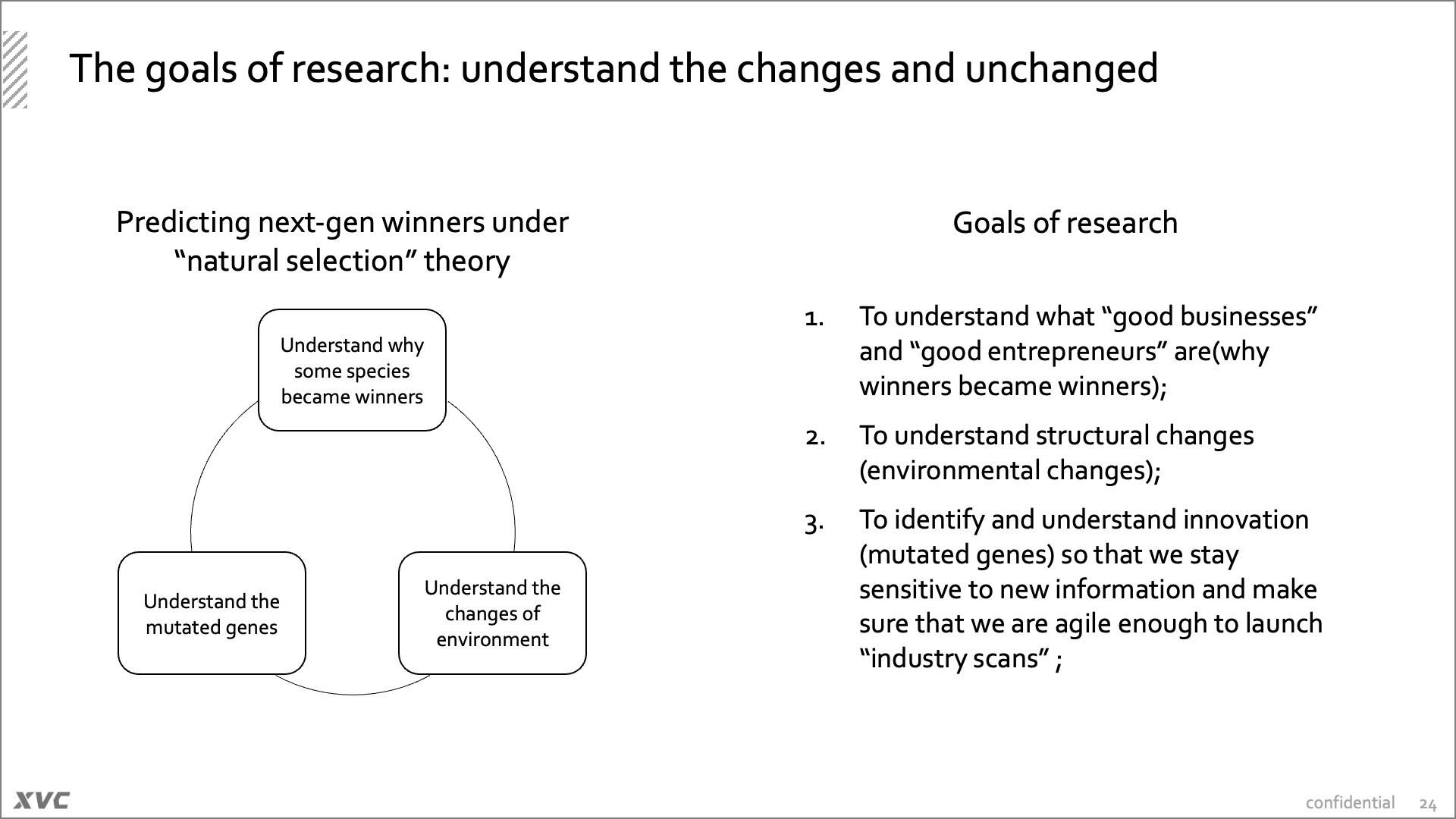

I find the natural selection theory a very good analogy to illustrate our understanding of the changes and evolutions of the business world.

We spend a lot of time trying to understand why some companies became winners in the first place. Companies like Tencent, Taobao, PDD, Meituan, ByteDance, and companies like Starbucks, McDonald’s, Coca-Cola, Costco, Aldi, or Kobe Bussan. What did they do right? How did their environment change? What are the differences between their environments and ours?

Then we need to understand the structural changes, at which point the changes will take place, and what kind of people can survive in the new environment.

Then we carefully observe the mutations – or innovations.

Such observations and thoughts can help us understand what will make a good business and a good entrepreneur in future scenarios while allowing us to stay sensitive to new information and make sure that we are agile enough to launch “industry scans” whenever they are needed.

These are the things that we set out to do when we open our eyes every morning.

It’s easy said than done. The truth is that the vast majority of our peers in the industry are finding it hard to get down to some real research.

As I’ve mentioned before, there are so many new deals out there. You passed over a dozen today, tomorrow another dozen will show up, and there are just so many decisions to be made. Some firms invest in 200 new names a year, which means almost one new deal every one-and-a-half days. Above all this, you have to move quickly because you can easily lose a deal if you are slow. Meanwhile, your portfolio companies can run into problems from time to time, and you need to run around to put out the fires. If you work in large firm, you also need to deal with internal competition. It’s likely to happen that when you are still doing research on some company, one of your colleagues has already brought the company up to the investment committee. You are exposed to a huge amount of information every day. Lots of new business models, new technologies, changes in the demographics, changes in consumer demand, new regulations, etc. It’s impossible to follow everything that’s going on around you.

In these circumstances, it’s very difficult for an investment professional to devote enough time to research – so much so that most firms do not believe in the importance of research for early-stage investment. Some firms simply classify entrepreneurs with a handful of labels, such as “industry veterans,” “overseas returnees,” and “young geniuses,” and make their bets based on the labels.

In this context, how can XVC ensure the quantity and quality of its research?

I think it’s still important that we have some faith. It is only when you believe you can see something that you are actually able to see it.

We have used different ways to embed an independent-thinking and research-driven culture into our processes and organization. We do a lot of light research across wide areas, and then follow by with smaller amount of deep research guided by a long-term mindset and fact-driven approach. On top of this, we’ve also built a review and feedback mechanism.

Let’s spend a few minutes to talk about XVC’s research framework.

One of the key elements in our research framework is to focus on the right questions.

Only 40 VC-backed companies in China that went public in the last decade became whales with a market cap of over $10 billion. When added together, these 40 companies have a market cap of $2.56 trillion, accounting for most of the market capitalization created by new IPOs. A well-performing fund is one that can catch these opportunities.

So, only four 10-billion-dollar companies per year. If a firm’s research area does not happen to cover the areas of these four companies, it will miss out on opportunities that year. If a firm fails to cover the relevant areas for several years in a row, it’ll be very hard for its fund to perform very well.

If we are obsessed with certain niche segments, we can easily spend a lot of time without finding any great opportunities. This is why we don’t easily commit ourselves to deep research. Instead, we do a lot of light research to broaden our cognition and make a quick judgment on the size and certainty of the opportunities first.

Another thing is that we are careful not to expand our “capability boundaries” too quickly. There are areas where we see high uncertainty, but where someone else might see high certainty. We don’t want to play games that are unfair to us.

This picture is a proxy variable that might help you understand what kind of mechanism we are using to make sure we do a lot of light research actively. Probably most LPs would think that VC firms hold weekly meetings to discuss and debate deals, and I’ve also heard that some firms hold weekly meetings for two whole days to discuss deals. At XVC, however, we have almost never discussed any live deals in our weekly meetings.

Our weekly meeting is for sharing. It motivates everyone to do research, and then allows each member’s research to benefit everyone else. It serves as a small window onto the very center of our culture and our institutional process.

The second element in our research framework is to collect information efficiently and identify its reliability.

As we’ve noticed during the many years of collecting information, information can easily get distorted in various ways during its processing and transmission, so much so that it becomes completely unreliable. What’s more, most “so-called” experts pretend that they are knowledgeable about something when they aren’t. Under such circumstances, we need to understand why and how certain information is distorted. This allows us to make a judgment about the reliability of the information we’ve obtained and decide whether to believe it or to throw it away.

Another thing is to use cross-verification to avoid the risks posed by a single source of information.

I’ll give you a small example here. It’s something we found while doing surveys. We found that ranking questions in questionnaires were largely ineffective because nearly 60% of the respondents would leave the rankings as they were. So, in the end, when the questionnaire was collected, the final ranking of the options will be the default ranking unless you find a way to randomize the default ranking.

Here’s another example. When we do interviews, we try to avoid asking intention-based questions, for example, “how do you think of something” or “what would you do to get something done.” Instead, the more effective questions are behavior-based ones, for example, “how did you handle a certain case before” and “what did you do in that process.”

These are just a couple tips among a thousand that can help us avoid distorted information.

The third element in our research framework is “attribute correctly.”

I’ve spotted many wrong attributions during idea exchanges with peer investors. For example, when we talked about why a certain company failed, a quick answer that many people would give is—because the company didn’t have the right genes. This answer was really giving me a pain.

At XVC, you’ll seldom hear someone attributing the failure of a company to its genes. We are fact-driven, and if we really want to talk about some problems in the genes, then we probably have to analyze in depth the specific behavioral patterns or thinking patterns that resulted in path dependence, the wrong decisions that the company made as a result, and the consequences that these decisions brought about, all the way to how such consequences led to the failure of the company. This is the discourse system that we use at XVC.

Another example is “strong execution.” When discussing the reasons for the success of a certain company, the most common explanation you hear is that it has a very strong team. But why is this team strong in execution? What actions or systems were built to ensure that it executes well? These questions are seldom explained properly.

How do we do attribution at XVC?

First, we turn big questions into smaller ones with rigorous logic and then try to collect facts to answer these smaller questions.

Second, we identify long-term and short-term factors, and we limit the influence of short-term factors on our judgment. This is also where our long-term mindset comes into play. We try to look at the long-term status of a company, as many of the short-term influences are nothing more than distractions.

For example, what impact does the COVID-19 pandemic have on investment? I don’t think it has very much impact. If we put it into a 10-year or 20-year cycle, we’d see that it has little impact on the vast majority of industries, so we shouldn’t be distracted by these short-term factors.

This is also the case when we look at deals. A lot of irrelevant information can be passed over very quickly, but any information that involves the thinking pattern of the founder is considered a long-term factor because it’s almost impossible for a company to change its founder.

Another example: if there’s something wrong with a company’s retention, and we see a problem in a company’s business model, we will probably walk away, as this is more likely a long-term problem. However, if the company’s financial performance suffered because it discontinued a partnership with a big sales channel, or a sales director had recently resigned from office, we may continue to be interested in the company because problems like this are short-term.

The fourth element in our research framework is using discipline to make sure System 2 plays a leading role in decision-making and to self-calibrate using a sounding-board mechanism.

(Here, System 2 is a concept from the book Thinking, Fast and Slow. It refers to “slow, deep, hard thinking” as opposed to System 1, which refers to “quick, instinctive, intuitive thinking.”)

Let’s put ourselves into one of our deal lead’s shoes for a minute. He works long hours, and usually goes to sleep at 1 am every day. He is now working on two live deals, one of which needs a decision in two days. This week, he has scheduled three coffee chats plus two dinners to discuss new deals, and three meetings with portfolio companies, in addition to the management interviews of the two live deals, each taking about five hours. And he needs to make a presentation about the wine industry in the weekly meeting next Wednesday. Today, he received 10 WeChat messages about new investment opportunities, including one from a friend telling him that a bubble tea chain headquartered in Kunming is raising its first round. Kunming is a city located in the south-west of China that takes a few hours to fly to from Beijing.

Our Investment Director Neil decided to push off a few meetings to fly to Kunming to meet with that bubble tea chain company founder on Saturday, and we signed our term sheet with that company seven days later.

Now you understand why most people who are still working in the VC industry are not research driven: it may be difficult for a research driven person to take the time to read those 10 WeChat messages carefully, and as a result, they will miss potential opportunities.

As an example, I will elaborate on our fourth research framework.

Our investment director, like his peers, is always in the work with complicated information. But he can still spare time to do research and make reasonable decisions based on the results. The reason is that we have a series of disciplines that can be implemented, prompting him to insist on using System 2 to think rationally under complex conditions.

For example, it’s important to think positively and negatively to see both the upside surprises and the downside risks. But it’s hard. It’s especially hard to do both at the same time. At XVC, we don’t set KPIs for the investment team members. However, I do reviews with each of them semiannually. The first item we go through is usually this: What unique contribution have you made to help XVC identify large opportunities and help the team improve its ability to understand those opportunities?

On the other hand, deal passion can cause problems too. I’ve had the experience of developing such a strong passion for an opportunity that it blinded me to seeing some obvious negative signals. To help our deal leaders manage their deal passion, we have designed a set of processes.

We have designed a checklist to help us make decisions. This checklist reminds us to calculate the TAM, score the PMF, score the barriers to entry, score the founder’s decision-making and organization development skills, and put down a confidence score with each score. In this way, we are forced to review the information we have and make sure that our judgment is fact-driven.

In addition to this, we’ve tried to build an environment where we can truly engage in independent thinking. As I mentioned before, we never discuss or debate deals in our weekly meetings. We use one-on-one meetings for discussion and debate so that each of us is asked some tough questions so that we return to an open-minded status to challenge ourselves. Furthermore, we encourage each participant in the deal to make their own investment decisions, independently, alone, not even in a one-on-one meeting.

This is the process that we’ve designed. We built the culture and used such tools and processes to make sure that System 2 is always in the dominant position throughout our opportunity-searching, research, and decision-making processes. This is the process that we’ve designed. We built the culture and used such tools and processes to make sure that System 2 is always in the dominant position throughout our opportunity searching, research, and decision-making processes.

These strategies and approaches to VC investing seem to be working against human nature and our intuition. However, we have to recognize that it takes a lot of hard work and sometimes a bit of luck to be a good investor. We also need to recognize that none of us are perfect. We all have our flaws and weaknesses. These strategies and approaches allow us to have extra patience in this competitive industry and in these fast-changing times so that we can get the better of our own flaws, weaknesses, motivations, and emotions.

Despite all the changes in the market environment, we believe that our approach can make friends with time. We just need to keep thinking hard, working hard, and keep doing what we are doing. And thanks to you, we have been able to build the XVC organization, build the XVC brand, and to meet and work with great entrepreneurs to build great companies. We have chosen to do our job in a hard way, but we enjoy doing so because we are entrepreneurs who happen to be venture capitalists.

Thank you again for supporting us. We look forward to a long-term and rewarding partnership.

Best wishes,

Boyu, on behalf of the XVC team

Appendix: